A while ago we published a first overview graphic of the german fintech industry. And there was no woman in a leading position. That is why we asked: Where are the Fintech-Women? Meanwhile there are arising more and more startups in the insurtech sector founded by women. I would like to share my thoughts with you about women in insurtech and also the thoughts of other insurtech women.

Facts & figures

- Traditional insurance industry is dominated by men: According to “DIW Managerinnen Barometer 2016”, only 9% of the managers in German insurance companies were women in 2015. 10 years earlier, women were only a minority of 2,5%.

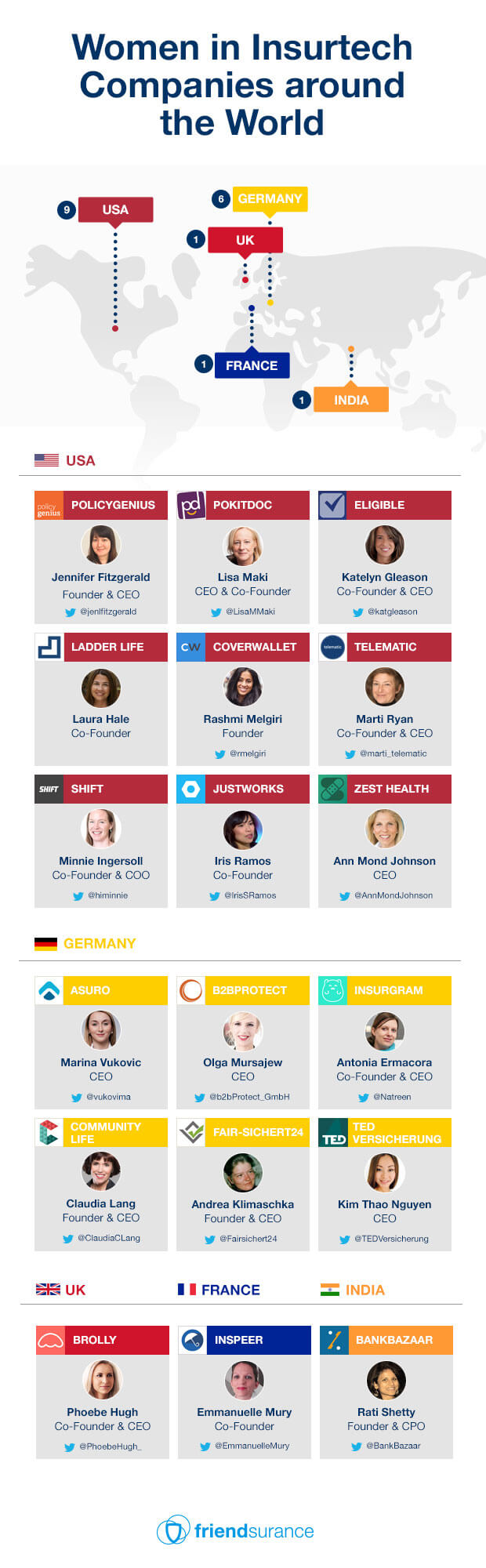

- Women in insurtechs around the world: From the 535 insurtech companies worldwide 20 are founded by women – at least 4%. Here you find more women just from the start in leading positions.

- More women are founding: More and more women are founding: According to DSM 2015 13% of German startups were founded by women. In 2014 it were only 10%.

- Friendsurance sets a good example: In our company we have around 40% women.

Women as the answer?

According to a study released by the management consulting company Oliver Wyman, in June 2016 women make up 16% of the executive members in financial service organisations worldwide. In Germany this figure is even lower, with only 10% women in executive committees. In my opinion a company which operates without women in management positions limits its possibilities. This applies in particular to financial service providers of all types. The crucial questions while filling a key position should be “Who is the best for the job?” regardless of gender. In some cases the answer will be a man. In others the answer will be a woman.

Adding a customer-centric mindset

Women are said to have high empathetic skills. According to my experience this is true more often than it is not true. But women bring along so much more than empathy. They can give fresh impulses to the conservative and so far man-dominated insurance industry in all sorts of issues. Especially when it comes to problem solving approaches and the industry’s lack of customer-centricity, women can create a great value. I have experienced a strong customer-orientation and its consequences in implementation by women.

Influence on the company’s success

Friendsurance, the insurtech company I am working for, has the vision to make the insurance business more customer-friendly. This is why we absolutely need people dedicated to customer-centricity.

For example, the head of our CRM team is a female colleague. She has an outstanding instinct to find out the actual customer expectations and translate them into the right measures. She has realised how important it is to show genuine respect in customer communication and has inspired the whole team to do the same. This helped us a lot in our company development. In total, one third of our management team is female with a diverse range of talent.

Insurance is more sexy than you think

To summarize: Woman can add high value to insurance companies. But what is in the insurance industry for women? The way I see it the new rising insurtech segment is an extremely interesting field with huge creative leeway and influence opportunities.

We are doing something nobody has done before. And we have the unique chance to change a whole industry by bringing together customer centric technical innovation and the insurance business. For my part, this is something I don’t want to miss.

We asked some of the foundresses from different insurtechs about their motivations, personal success and experience in the insurtech industry. Their insights are really inspiring and interesting.

Minnie Ingersoll, Shift

Minnie Ingersoll, Shift

(marketplace for used cars that come with insurance, warranties and financing)

„At Shift our entire product is about providing a used car buying or selling experience that is pleasant, non-aggressive and non-salesy. We have found that this approach particularly resonates with women. In order to provide an experience that serves a diverse population, we believe it’s necessary to have diversity in the team that is building the product. I think there will be more women in leadership positions in business across the board. I think we’ll continue to have more equality in the workforce as we continue to have more equality in the home.“

Emmanuelle Mury, InsPeer

Emmanuelle Mury, InsPeer

(peer-to-peer insurance provider)

„I think that everyone with good ideas and the ability to execute them can influence the market. The important is to keep a mix of people thinking differently, coming from various horizons and with complementary expertise in a team. In the end, it is not so much about gender but more about diversity. Last month, I was participating to a conference organized by a school training experts in Insurance (ENASS). All the organizers were female students and I was truly impressed by the quality of the organization and of the event. So our successors are already there and they look pretty good!“

Christine Kiefer, Fintech Ladies

Christine Kiefer, Fintech Ladies

(the first german fintech network for women)

„Although the Fintech- and Insurtech Industry aim to digitalise products and services, the human touch will always be an important success factor in product and service design. People think and act in different ways, so a diverse team is crucial to ensure that products appeal to both men and women, and not just half the customer base.“

Marina Vukovic, Asuro

Marina Vukovic, Asuro

(insurance contract management and brokerage app)

„Generally, I believe that there will be more women in tech startups and in leading positions, but the race is long – and explicitly in insurtech even longer. Traditionally, the traditional insurance sector is full of grey-haired managers who do not need/want to think about gender equality, but they will be forced to as there is limited interest among the new generation to their sector.“

Claudia Lang, Community Life

Claudia Lang, Community Life

(digital insurance provider and online community)

„Technology is the tool behind the insurtech industry that allows us to make things better for people who need insurance. Perhaps women can bring exactly that perspective: Technology is not a purpose in itself – its only justification is to make our lives better. Rather than getting engrossed with technology, women may focus more on outcomes that technology can deliver.

I also think that mixed gender management teams produce very good results. When I lived in Ireland, half of the insurance company’s board consisted of women. I realise it is not easily measurable, but I found that the gender mix contributed significantly to the exceptionally high quality decisions and outcomes we achieved.“

Antonia Ermacora, Insurgram

Antonia Ermacora, Insurgram

(insurance chat bot)

„My personal success? This year I started the first insurtech meetup in Berlin as I wanted to get connected to the scene and exchange learnings with other startups. I was worried that maybe Germany isn’t ready for insurtech but no need to worry: the event was a great success and we have started the first startup cooperations!“

Marti Ryan, Telematic

Marti Ryan, Telematic

(cloud based platform that creates personalized pricing models based upon car driving behavior, mobile phone usage, and lifestyle behaviors for the insurance industry)

„I think where women can most strengthen the insurtech industry is by creating new solutions using a broader and more wholistic view of the insurance ecosystem. The more diverse the voices at all levels of decision making, especially board rooms balanced with empathy for all stakeholders, including the environment, employees, consumers, and underserved populations is necessary to move insurance forward in a sustainable way. Insurance has a huge opportunity to collaborate and make the world a better place for all. It needs all voices at the table to do this.“

Ann Mond Johnson, Zesthealth

Ann Mond Johnson, Zesthealth

(provider for health insurance)

„Women think more holistically. When they think about insurance, they want both ease of transacting business (which is where technology comes in), as well as the ability to create a relationship for advice and services. We’re finding that technology on its own doesn’t do the trick. You need a human component, as well. Technology well deployed can make insurance tools scalable, but a human element will make them more successful.“

So what do you think? Should Insurtechs benefit from women or is it not a question of gender? Let us discuss!

Eva Genzmer, Head of Corporate Communications

Eva is a PR professional with more than ten years of experience. In 2014 she started at Friendsurance and built up the media relations from scratch. She is responsible for the communication strategy of Friendsurance in Germany.